Unlocking Opportunities: Understanding Prop Trading Funds

In the fast-paced world of finance, prop trading funds stand out as a compelling avenue for traders looking to maximize their potential and investors seeking viable returns. These funds create a unique environment where skilled traders are empowered to operate without the financial risks usually associated with trading their capital. By understanding the mechanics and benefits of prop trading funds, both traders and investors can make informed decisions that lead to mutual success.

What is a Prop Trading Fund?

A prop trading fund or proprietary trading fund is an investment vehicle that allows traders to use the firm's capital to buy and sell financial instruments, including stocks, options, futures, and forex. Unlike traditional trading environments where individual traders utilize their own capital, prop trading funds provide their traders with financial backing, removing a significant barrier to entry for talented individuals who may lack sufficient capital.

How Do Prop Trading Funds Operate?

Prop trading funds operate on a model where the firm earns money based on the trades executed by their traders. Here's how the system typically works:

- Talent Acquisition: Prop firms actively seek skilled traders who possess a proven track record. These traders are often evaluated on their strategies, risk management skills, and market insights.

- Capital Allocation: Once selected, the firm allocates capital to the trader, enabling them to trade on behalf of the firm rather than using their own funds.

- Profit Sharing: Traders usually receive a share of the profits generated from their trades. The sharing model can vary significantly, where traders can earn anywhere from 50% to 90% of the profits depending on their performance and agreements.

- Risk Management: Prop firms typically enforce strict risk management protocols to safeguard their capital. This ensures traders operate within predefined risk parameters and helps in maintaining the long-term viability of the fund.

The Advantages of Prop Trading Funds

Participating in a prop trading fund offers several advantages for both traders and investors:

Advantages for Traders

- Leverage Capital: Traders can utilize substantial capital without risking their savings, allowing them to take larger positions in the market.

- Access to Resources: Many prop firms provide traders with advanced trading tools, proprietary analysis, and educational resources to enhance their trading strategies.

- Collaborative Environment: Working within a team of experienced traders fosters a learning atmosphere where individuals can share strategies and insights.

- Profit Potential: The capacity to earn a higher percentage of profits motivates traders to perform at their best.

Advantages for Investors

- Diversification: Investors gain exposure to a wide array of trading strategies and asset classes, leading to potential diversification of their investment portfolios.

- Professional Management: By investing in a prop trading fund, investors leverage the expertise of seasoned traders, enhancing the likelihood of achieving favorable returns.

- Performance Incentives: The structure of profit-sharing ensures that traders are motivated to perform competitively, aligning their interests with those of the investors.

- Market Access: Prop funds often have access to institutional-grade trading platforms and liquidity providers, leading to better execution prices for trades.

Challenges Associated with Prop Trading Funds

While there are many advantages, there are also inherent challenges to consider:

- High Competition: The barrier to entry can be stringent, and many traders face tough competition when attempting to secure a position in a reputable prop trading fund.

- Stressful Environment: Trading can be highly stressful, particularly when large sums of capital are involved. This pressure can lead to poor decision-making and emotional trading.

- Fee Structures: Some prop trading firms may charge fees that can cut into the profits of traders, leading to a smaller share than initially anticipated.

- Risk of Losses: In highly volatile markets, even experienced traders can incur significant losses, affecting their profitability and the fund's overall performance.

The Future of Prop Trading Funds

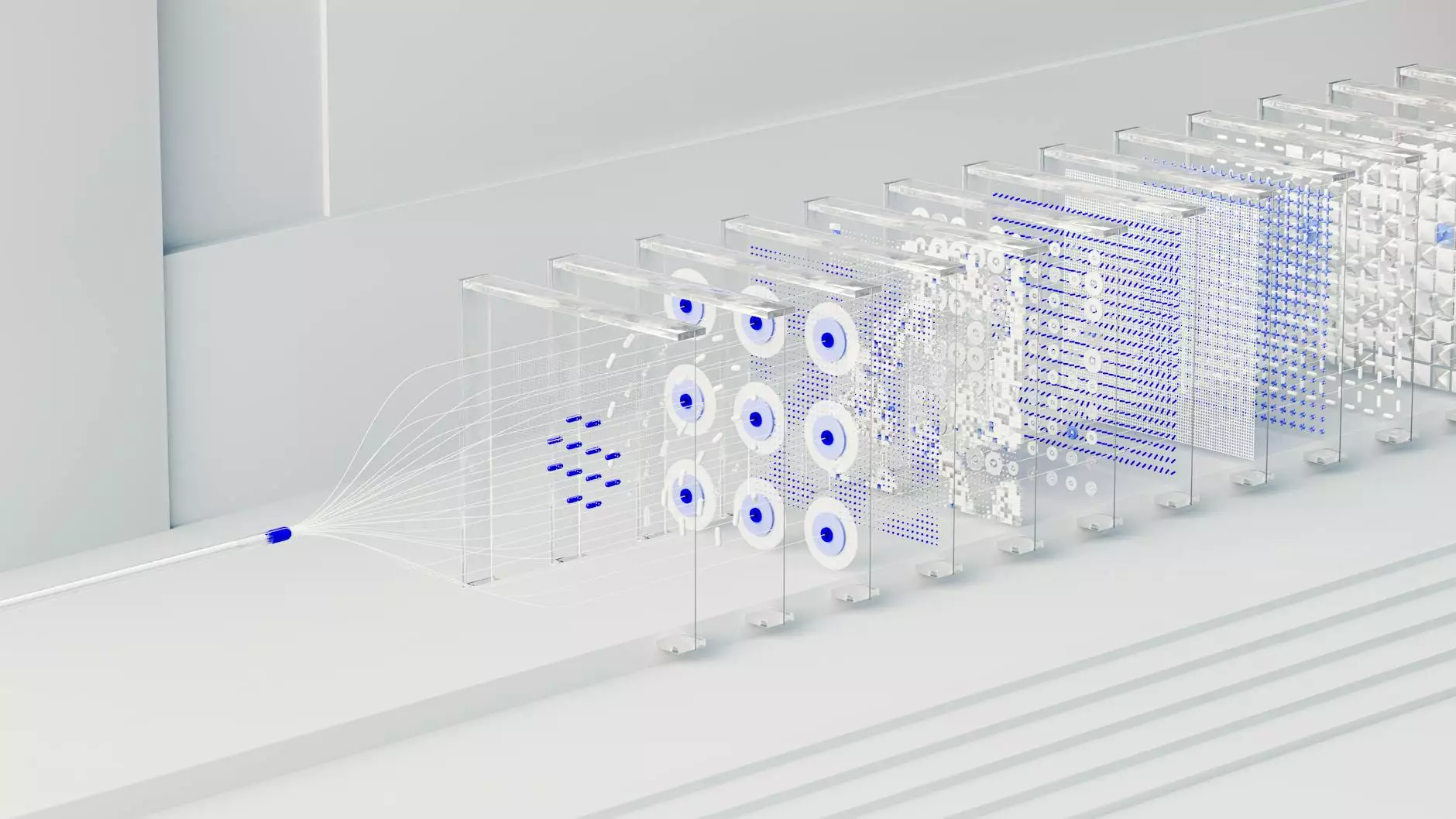

As financial technology continues to evolve, prop trading funds are poised to adapt and thrive. With the increasing role of artificial intelligence and machine learning in trading strategies, firms that integrate these technologies can enhance their trading efficacy and risk management processes. Here are a few trends shaping the future of prop trading:

Technological Advancements

The integration of advanced algorithms and trading systems will transform the landscape of prop trading funds. Traders equipped with cutting-edge technology can analyze vast datasets and execute trades at lightning speeds, maximizing profit potential while mitigating risks.

Remote Trading Environments

As remote work becomes more prevalent, many prop trading firms are adjusting to the trend by allowing traders to operate from anywhere in the world. This flexibility not only broadens the talent pool but also cultivates diversity within trading approaches, ultimately benefiting the fund's performance.

Regulatory Changes

With the ongoing evolution of financial regulations, prop trading funds must stay ahead of compliance requirements to maintain operational integrity and investor confidence. A proactive approach to regulation will ensure that firms can navigate challenges and capitalize on new opportunities.

Choosing the Right Prop Trading Fund

For aspiring traders and investors looking to get involved in the world of prop trading, selecting the appropriate fund is critical. Here are some key factors to consider:

- Reputation and Track Record: Research the fund’s history, profitability, and the performance of its traders to understand its position in the industry.

- Fee Structure: Carefully review the fee agreements and profit-sharing arrangements to ensure that they align with your expectations.

- Support and Resources: Investigate the support system and resources provided to traders, including training programs, mentorship opportunities, and trading tools.

- Risk Management Policies: Understand the fund’s approach to risk management and how it protects both traders and investors from excessive losses.

Conclusion

In summary, prop trading funds represent a dynamic and lucrative sector within the financial markets, offering exceptional opportunities for skilled traders while providing investors with the potential for substantial returns. By examining the intricacies of how these funds operate, their benefits, challenges, and future prospects, individuals can better position themselves for success in this exciting field. Whether you are a trader looking to elevate your career or an investor seeking a strategic advantage, exploring prop trading funds may just be the key to unlocking new financial horizons.